Only after reinvestment is fulfilled does surplus exit the loop.

Why Most Men Never Build Wealth—and How Economic Order Changes Everything

An investor invests time or money into a system. An Investor manages managers who operate a system.

An Operator operates a system as a manager.

I can tell you from 20+ years of entrepreneurship and testing to find out what works and what doesn’t that systems and infrastructure are what most entrepreneurs are needing to focus on to expand and grow. You have to decide if you are an operator or an investor.

I have realized after asking myself what my Valuable Final Products are on a daily basis and what statistics are counted at the end of every workday to determine my level of success for the day. When you are “building a company” as an operator and hiring staff to replace yourself there are times when you are working ON your business and times you are working IN your business. Every entrepreneur who starts from $0 must first be an operator before he can replace himself with staff, then managers then become an investor.

THE MASTER PLAN: What’s Your Master Plan?

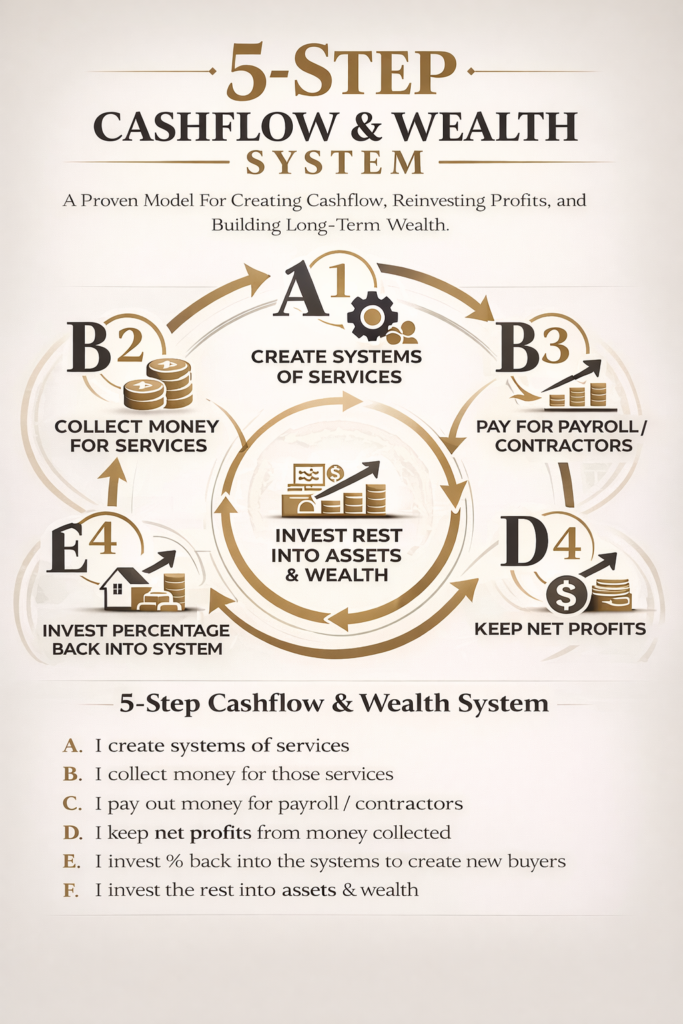

You must have a Master Plan for every effort and every dollar that comes into your possession. Money always follows systems. You must have a SYSTEM to build and manage your money. We teach “The Closed Loop Money System – The Profit First Cashflow Flywheel“. This SYSTEM teaches you to start at the beginning and end at the end whilst determining where you are on that timeline of growth. We teach business owners that are millionairs already and we teach young boys who are starting their first lawn mowing business. These principles apply to those who are broke and those who are already rich to make you richer.

For me, my every day balance is working on the system IE; infrastructure and people IE; Teams. I collect money for services rendered by my TEAM and then release PAYROLL and my company keep the NET PROFIT. That NET PROFIT must then be RE-INVESTED in the SYSTEMS that created the CASHFLOW to begin with. Plus, the surplus is then invested in other ASSETS that also create CASHFLOW creating a wealth flowing CLOSED LOOP SYSTEM> where BUCKETS are used to collect NET PROFITS from the services your systems render.

Most men believe their financial problems are caused by insufficient income. They assume that if they could just earn more, everything would stabilize. But history—and reality—show otherwise. Men at every income level struggle, collapse, and lose everything not because they didn’t make enough money, but because the money they made was never governed.

Money that moves without structure leaks. Money that leaks cannot compound. And money that cannot compound can never become wealth.

This is not a motivation problem. It is not a mindset problem in the modern sense. It is a systems problem.

At MultiGen, we teach what we call The Closed Loop Money System—a practical economic doctrine designed to prevent money leakage and convert income into enduring power. It is the difference between surviving financially and building something that lasts.

Why Open Loops Destroy Men

An open money loop looks like this: income comes in, expenses go out, and nothing remains. The man may earn well, but he never feels stable. When income slows, stress spikes. When expenses rise, everything breaks. There is no buffer, no engine, no control.

Open loops are deceptive because they can function for years—sometimes decades—before collapsing. They hide fragility behind motion. But motion is not progress. Without retention, reinvestment, and structure, money eventually disappears.

Closed loops behave differently. They recycle energy. They feed themselves. They stabilize under pressure. Nature works this way. So do civilizations. So must men who intend to build legacies.

Systems Come Before Money

Every closed loop begins with a system.

Money is never the first step. Systems of service are. A system is repeatable value that exists independently of your constant effort. It can operate with people placed into roles rather than relying on personality, hustle, or heroics.

Men who chase money before building systems remain operators forever. Men who build systems first graduate into governors. The difference is not intelligence or ambition. It is order.

Without systems, money has nowhere to land.

Collection Must Follow Service

Money is not chased in a closed loop. It is collected.

Collection only occurs after value has been rendered through the system. This removes desperation from the process and anchors income to reality rather than hope. When collection is clean, it carries no emotional weight. It becomes procedural.

This single distinction separates ethical wealth from financial anxiety. Money is no longer personal. It is transactional.

Payroll Comes Before Profit

Before profit is claimed, obligations are fulfilled.

People who build and maintain the system are paid first. This is not generosity—it is infrastructure. Unpaid or delayed labor erodes trust, poisons morale, and weakens the system from within.

Strong systems pay their people consistently and predictably. Weak systems justify shortcuts and eventually collapse under them.

Profit that depends on unpaid effort is false profit.

Profit Is What Remains

One of the most damaging financial delusions is the belief that revenue equals success. It does not.

Profit is not what you hope to keep. It is what remains after all obligations are honored. Retention requires discipline. It requires waiting. It requires resisting the urge to spend before the math is complete.

Men who retain profit think differently. They stop reacting and start governing. They move from survival to control.

This is the turning point.

Feed the Engine Before You Extract Wealth

Before wealth is extracted, the system must be fed.

A defined percentage of profit is reinvested back into the system—into marketing, infrastructure, talent, and capacity. This is what allows the loop to compound.

Growth without reinvestment is theft from the future. Systems that are not fed die, regardless of how successful they once were.

This reinvestment closes the loop and returns the system to its starting point, now stronger than before.

Assets Are Storage, Not Engines

Only after reinvestment is fulfilled does surplus leave the loop.

That surplus is converted into hard assets: real estate, reserves, equity, or other long-term holdings. Assets preserve value. They do not produce it.

Men who build assets before systems trap themselves in maintenance and fixed costs. Men who build systems first acquire assets with ease.

Wealth is frozen labor. Cashflow is living labor. Confusing the two is fatal.

The Power of a Closed Loop

The Closed Loop Money System replaces chaos with order. It eliminates leakage. It creates stability under pressure. It allows income to compound rather than disappear.

Most men are not poor because they lack opportunity. They are poor because their money has no structure.

Wealth is not created by earning more. It is created by governing what you already earn.

And governance is the foundation of legacy.

The circular diagram (this is the key insight)

The circle shows a closed-loop money system, not linear income.

A — “Create & invest in systems & people”

You build:

Marketing systems

Service systems

Teams / contractors

This creates production capacity.

B — “Collect money for services rendered through the system”

Money comes in because the system produces value, not because you personally grind.

This is revenue capture.

C — “I pay out money for services to contractors”

You pay:

Labor

Fulfillment

Operations

This converts revenue into net profit potential.

D — “I keep net profits from money collected”

This is the most important part.

You explicitly separate:

Revenue

Expenses

Net profit

Most people never do this consciously.

E — “I invest into the system to create new buyers”

You reinvest:

Marketing

Infrastructure

Scale

This feeds back into Step A, expanding capacity.

F — “I invest the rest into hard assets / wealth”

Only after the system is fed do you extract:

Assets

Property

Long-term wealth

You dont get RICH off the CASHFLOW. You get RICH off the PRODUCING ASSETS the CASHLFOW buys. Rental houses, other incomes or other companies, new service offerings, new products or new locations. You invest a percentage of the NET PROFITS into OTHER INCOME STREAMS. This makes you RICH. The NEW MONEY now flows into buckets of its own which you can label FERRARRI, BEACH HOUSE, VACATION or OTHER INCOME STREAMS> Most people make the mistake of violating the AFFLUENCE Conditions formula and try to be RICH off the CASHFLOW their companies create too soon.